www.FedPrimeRate.com: The Pros And Cons Of Using Multiple Banks

The Fed has all but succeeded at bringing inflation down to a comfortable level here in the USA.

So, at this point in the inflation cycle, with short-term rates at their peak, the next rate move by the Fed will almost certainly be down.

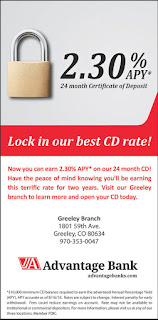

That's why you may have noticed a lot of buzz about certificates of deposit right now. It's a very good time to lock-in great yields from banks and credit unions all across the nation.

|

| CDs | Money | Banks |

By: > Andrew Lisa

Modern banks are one-stop-shop financial institutions. Many offer the convenience of checking, savings, money market, brokerage, retirement, loan, and credit card accounts all unified under one roof -- regardless of whether that roof is real or digital.

Although modern consumers can handle nearly all their financial needs with one bank, they certainly don’t have to. So, does it make sense for most people to consolidate their financial services with the same institution, or would it be wiser to spread their money around to different accounts at different banks?

The answer is that it depends. No two financial consumers are the same, and both strategies have benefits and drawbacks.

GOBankingRates.com consulted experts in the banking and financial sectors to determine the pros and cons of using more than one bank.

PRO: BRICK-AND-MORTAR SERVICE WITH ONLINE BANK YIELDS

Gary Zimmerman is the founder and CEO of MaxMyInterest, a cash-management platform that automatically directs money between bank accounts based on which is paying a higher interest rate at a given time. The money stays in the account holder’s name throughout and retains full liquidity and the protection of FDIC insurance.

In his experience, the primary benefit of maintaining accounts at different banks is to enjoy the old-fashioned service and attention of tellers at physical branches as well as the convenience, feature-rich apps and far superior savings yields of online-only banks. So savvy savers might want to open multiple accounts — a core brick-and-mortar checking account plus higher-yielding online savings accounts.

PRO: LOCAL BANK FAMILIARITY PLUS CORPORATE GLOBAL REACH

Benefiting from the best traits of physical and digital banking is not the only perk of opening accounts at different banks. Experts also suggest putting some of your money in your local bank or credit union and some in a big, corporate bank with national or even global reach.

This strategy allows you to support your neighborhood institution, whose employees are familiar faces and members of your community, while also having access to thousands of ATMs and other services no matter where you go through your account with a brand-name corporate bank.

PRO: INSURANCE COVERAGE WITH EACH ACCOUNT AT A NEW BANK

In 2023, several high-profile bank failures reinforced the importance of FDIC insurance. Deposits under the insured limit were quickly made whole, but every dollar over the maximum was at risk of being lost forever. If you have significant deposits, you must do your banking with insurance in mind.

“There’s a safety aspect,” said David Rafalovsky, CEO of Oxygen, a banking services and financial technology platform. “Spreading your money across different banks can protect you under the FDIC insurance limits.”

It’s essential to understand that multiple accounts at the same bank will not keep your money safe.

According to the Federal Deposit Insurance Corporation, “The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank.

“For example, if a person has a certificate of deposit at Bank A and has a certificate of deposit at Bank B, the amounts would each be insured separately up to $250,000. Funds deposited in separate branches of the same insured bank are not separately insured.”

CON: SCATTERED ACCOUNTS ARE A CHALLENGE TO MANAGE

“Brick-and-mortar banks typically pay rates that are well below the rate of inflation, which means you’re losing purchasing power every day,” said Zimmerman. “While you might want to keep your main checking account at a brick-and-mortar bank, online banks have lower operating costs, and so they’re able to pay higher rates on savings.”

When you keep all your accounts in the same place, you can check in with them all at once at a glance. You have only one password to remember, one app to download and you receive only one set of alerts and communications.

On the other hand, managing money scattered across multiple institutions can be frustrating and time-consuming.

“It can become increasingly more difficult to keep track the more you have under your name,” said Matt Gromada, head of family banking at Chase.

CON: IT’S EASY TO MAKE EXPENSIVE MISTAKES WHEN YOUR ACCOUNTS ARE SPREAD OUT

The added difficulty of keeping up with accounts strewn across multiple institutions goes beyond just convenience — mismanagement can lead to costly errors. “Managing multiple accounts requires more time and effort,” said Rafalovsky. “There’s a higher risk of incurring fees, especially if you’re not meeting minimum balance requirements. And let’s not forget the potential for confusion and stress. Balancing several accounts can be overwhelming, leading to errors like missed payments or oversights in budgeting.”

CON: YOU CAN HANDICAP YOUR OWN COMPOUNDING

The main attraction of spreading out your accounts is buffet banking — you get to take what you like and leave what you don’t from each institution. But if you have too many savings accounts, you can hobble your own yields and forfeit precious compounding power.

“In addition to the need for more upkeep, you can lose out on savings interest by having multiple accounts,” said Gromada. “Generally, you will typically earn less interest on several smaller accounts than one big one."

Not only is it harder to keep up with changing rates among several accounts, but many banks have a tiered rate structure, and with your dollars spread thinner, it can be harder to meet the minimum balance that you need to get the best rates.

========

SOURCE: https://www.gobankingrates.com/banking/banks/banking-expert-pros-cons-of-using-multiple-banks/

========

Labels: Banking, Banks, CD, certificate_of_deposit, High_Yield_CD, High_Yield_Certificate-Of-Deposit, high_yield_savings, Money, money_market, Saving, Saving_Money, savings

|

--> www.FedPrimeRate.com Privacy Policy <--

> SITEMAP < |